“Stories are not indicators; they ARE the organization.”

– David Boje, storytelling researcher

Automation? Frictionless? Impersonal.

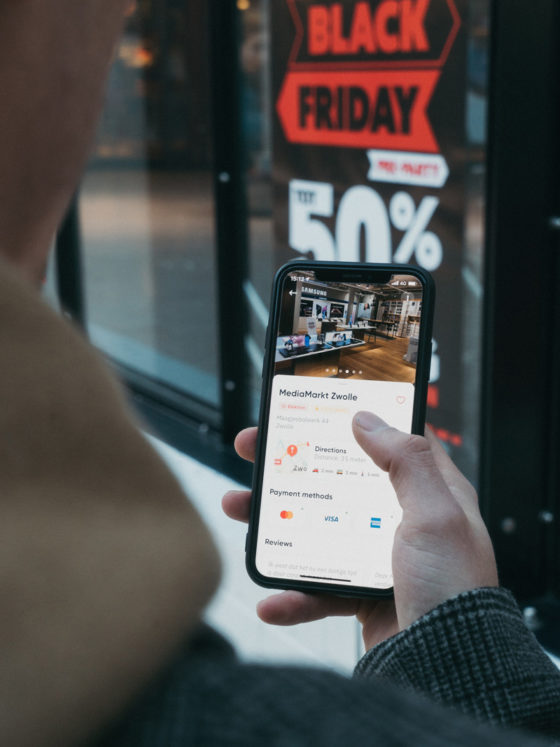

It seems that new tech being used in the retail industry removes the human touch from the shopping experience. Why get in a checkout line when you can just scan your items as you put them in the cart? Why wander through the store when you can place the order from an app and pick it up from a locker? Why even bother going at all when you can just order it online and have it delivered?

Certainly, transactional retail has its place. There’s no need to go to the store to order toilet paper or mouthwash. But for most shopping and dining experiences, customers crave personal interaction; it’s why they come in rather than order online in the first place.

“Emotion is what really drives the purchasing behaviors, and also, decision-making in general.” -Logan Chierotti, CEO of Physician’s Choice

Frictionless, Not Sanitized

When did we decide that the retail journey should be so linear? Perhaps as a result of covid, the retail journey now comes with fewer human interactions, but does it have to be so cold and despondent? Sure, customers want a “frictionless” experience in terms of complications, delays, and frustrations. But do they want the shopping experience to be devoid of human contact so there is no emotional involvement in the process at all?

We don’t think so, and science says it’s not possible. Yet retailers from restaurants to department stores are rushing to make their operations more frictionless: “Here’s your purchase; we already have your money—don’t let the door hit you on the way out.”

An exception is IKEA, but they’ve created their own version of impersonal—a retail cattle drive through a labyrinth. The Goal: Get the herd from Point A to Point B without turning around. Keep them moving forward until they’re dumped out into an open pasture (warehouse) and then funneled through the corral (checkout line).

So how do retailers create more human connections in the retail journey? Through retail storytelling.

“Story, as it turns out, was crucial to our evolution—more so than opposable thumbs. Opposable thumbs let us hang on; story told us what to hang on to.” -Lisa Cron, author of Wired for Story: The Writer’s Guide to Using Brain Science to Hook Readers from the Very First Sentence

What Is Retail Storytelling?

Retail storytelling is the use of narratives to create an emotional connection between a brand and its customers. While retail storytelling can be educational and entertaining, the goal is to help create a lasting and memorable impression of the brand on the customer.

Human brains connect to the emotions behind the stories, creating emotional connections between the customer and the brand that help customers build trust and loyalty.

“Good stories surprise us. They make us think and feel. They stick in our minds and help us remember ideas and concepts in a way that a PowerPoint crammed with bar graphs never can.” – from Joe Lazauskas and Shane Snow’s book The Storytelling Edge: How to Transform Your Business, Stop Screaming into the Void, and Make People Love You

Why Is Retail Storytelling Important?

The retail industry is incredibly competitive, and shoppers are fickle. They follow budgets more than brands, and convenience more than company names. They research before they shop. They need a reason to connect with your company and brand and they are looking for brands that are aligned morally and socially with their own beliefs and desires. Retail storytelling is one of the most powerful ways to connect with consumers in meaningful, impactful, and most of all, memorable ways.

“People don’t buy what you do; they buy why you do it and what you do simply proves what you believe.” -Simon Sinek, author of Start with Why

How to Make Retail Storytelling Work for Brands

For brands, the key to storytelling that connects with their target audience is about leveraging technology innovatively. Brands should use data–about their customers, sales, and products–to help inform the stories they tell. Ad agency FIG Founder Mark Figliulo explains, “I think a new approach to data could unlock a new era of creativity. The reason is simple; when clients understand and can track what kind of stories work, they will be begging for very simple messages and very surprising executions because that’s what the data shows.”

“Every business has a story to tell.” -Jay Baer, author of Hug Your Haters: How to Embrace Complaints and Keep your Customers

Brands Killing It with Retail Storytelling

Retail storytelling isn’t new. Coca-Cola was teaching us to sing in perfect harmony in the early ‘70s. They were selling Coca-Cola as an avenue to friendship, world peace, harmony, and love. AT&T did it in the ‘80s by sharing the story of connection during the holidays. And who didn’t shed a tear over the countless Hallmark commercials in the ‘90s?

The delivery method has changed, but the messaging remains. Brands need to connect—emotionally—with their customers. Here are five brands getting it right in today’s times:

Nike – Using words, images, and people to tell their story, the Nike brand connects (again) to the idea of equality with their, “Until We All Win” equality” campaign. “Nike believes in the power of sport to unite and inspire people to take action in their communities. Equality isn’t a game. But achieving it will be our greatest victory. Until we all win.”

Warby Parker – This DTC original disrupted an entire industry and gained a loyal customer base by telling the personal story of their founder, who lost his glasses. “Every idea starts with a problem. Ours was simple: Glasses are too expensive.”

Learn more about storytelling at retail in our DTC guide >

Airbnb – Master storytellers with a compelling founder story, their evolving story centers around inclusion, trust, and experience—and most recently resulted in the CEO acknowledging problems and making changes to the platform because of guest concerns over hidden pricing. They rely heavily on user-generated content, which is featured on their Instagram page.

Land Rover/Range Rover – They help their customers see what it would be like to be in the driver’s seat of one of their vehicles by sharing adventure stories.

Woolrich – One of the featured brands inspiring our team, Woolrich demonstrates their commitment to sustainability in everything they do, including a partnership with 1% for the Planet.

”The most powerful person in the world is the storyteller. The storyteller sets the vision, values, and agenda of an entire generation that is to come.” -Steve Jobs, Apple co-founder

The Keys to Successful Retail Storytelling

Retail storytelling must be authentic, engaging, and thoughtful. Brands are more likely to connect with honesty and a behind-the-scenes look than with a manufactured story that doesn’t have the ring of truth.

Storytelling should be incorporated into everything a retailer does. Brands should build it into the store design and visual presentations, bake it into the ways the company sources materials, and every employee—from those on the retail floor to the brand leaders in the C-Suite—should understand and tell it. It’s about connection. Stories can create empathy and connection, elicit emotions, and forge connections that build loyalty. What’s the retail story your brand is telling?