share this article

Dubbed “Test City, USA,” our hometown of Columbus, Ohio is a mecca for start-ups and product testing. The demographics here mirror the larger United States, in a nice mid-sized, Midwestern package.

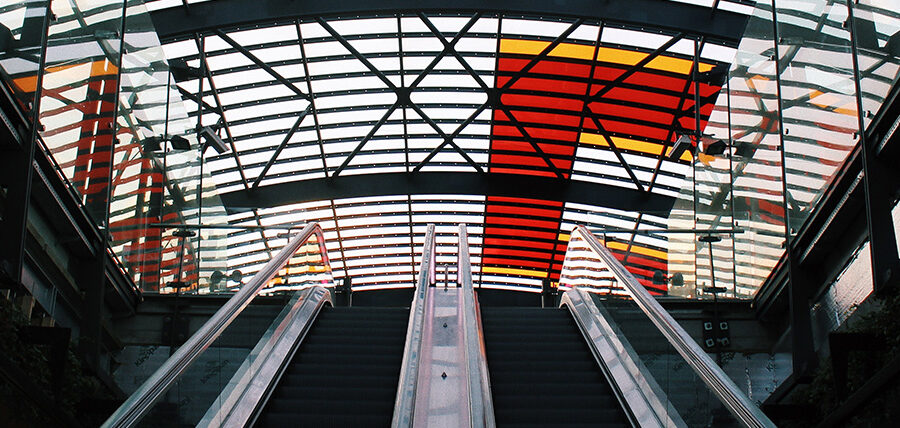

In the northeast quadrant of the city is Easton Town Center, a pioneer in mall design. Since opening in 1999, it has tested the possibilities for open-air retail that includes high-end retailers, department stores, brick-and-mortar direct-to-consumer stores, restaurants, entertainment venues, and more.

Today it continues to innovate with EastonLABS, a 500-square foot retail space that retailers can rent to test new products. The mall has since added Restau/Lab to give restaurants the same opportunity.

Flagship stores also are transforming into dynamic community spaces—hubs of creativity, collaboration, and community engagement. These “open HQs” allow brands to integrate consumer input directly into the design and development process and foster positive customer experiences at the same time.

“The retail market is under pressure. The retail landscape is evolving. Success at the shelf is no longer about the depth and breadth of inventory, but rather creating engaging experiences for customers. Change is the new paradigm. Retailers need to adapt to current trends to keep a seat at the table.”

– Deloitte

Companies like HP, Starbucks, Ikea, Sephora, and even Major League Soccer have all launched innovation labs and Open HQs to explore new business models, enhance customer experiences and stay competitive.

Yet the vast majority of innovation labs – a whopping 90% according to one industry report – fail or eventually close, falling short of the success they hoped to accomplish.

Here is what retailers who want to stay ahead of the curve and meet consumer demand for a better experience should know about exploring innovation models and avoiding potential pitfalls.

Engaging the Customer in Innovation

Consumer demand for personalization has only been growing, with 71% expecting businesses to get to know their individual interests. Furthermore, 80% of customers agree that the customer experience is just as important as products and services. Open HQs and creative hubs allow retailers to integrate consumer feedback directly into their processes, fostering a sense of community, and improving customer insights. Retailers are hoping to create a new breed of consumers who are emotionally invested in the brand. And with a staggering 72% of total U.S. retail sales projected to (still) happen in physical stores by 2028, the open HQ model offers customers a place to connect personally, even one-on-one with the brand.

An Evolving, But Not-New Concept

The Genius Bar, where customers receive tech support directly from experts, epitomizes the brand’s commitment to customer engagement and service.

Apple Senior VP of Retail Angela Ahrendts explained that she wanted Apple stores to be a town square, “where the best of Apple comes together and everyone is welcome.”

Several retailers in the United States have introduced an Open HQ model, including Nike’s House of Innovation in New York City. Nike offers personalized experiences where shoppers can test products, provide feedback, and even see prototypes in development. This interactive environment not only enhances the shopping experience, but also allows Nike to gather valuable consumer insights.

Nordstrom’s Innovation Lab has continually learned from trial and error how to refine the lab process and continues to lean in to new technologies that allow customers to personalize products and experience seamless online-to-store integration. Their commitment to experimentation and customer-centric solutions sets them apart.

Walmart’s Intelligent Retail Lab (IRL) is focused on customer experience and efficiency. Residing in a 50,000-square-foot Neighborhood Market store in Long Island, the lab uses thousands of cameras on the ceiling and sensors embedded in shelves to monitor the store in real-time to improve efficiency, keep costs down, and enhance the shopping experience for customers. The cameras can even detect the ripeness of produce based on color alone and alert workers when restocking is needed.

In London, the Samsung KX space in King’s Cross is a striking example of a tech brand embracing the Open HQ model. The venue features a range of experiences, from product demonstrations to workshops and events. Visitors can interact with Samsung products in a relaxed, communal environment, providing feedback directly to designers and developers.

Challenges in Innovation

While the Open HQ and Innovative model offers numerous benefits, it also presents significant challenges. Although many companies have announced new labs, just as many have announced closures.

Earlier this year, Walmart announced the closure of its Store No. 8 innovation hub to cut costs. The retail giant cited the lack of the need for the hub as the reason behind the closure since many of the interactive technology features it was testing are now integrated into several stores.

Ikea’s Space10 lab also shut down last fall after the cofounders stated they had reached all the objectives they had set for the lab. One of the lab’s developments in the decade that it was open was the creation of an augmented reality app that allowed consumers to use their phones to see what a furniture piece would look like in their living spaces.

The very way Open HQs and innovation labs are designed lends itself to challenges. Because innovation is continually evolving, labs will inevitably date themselves and risk becoming obsolete. Because of the costs associated with running Open HQs and innovation labs, retailers may close them more quickly if they fail to produce immediate and tangible results. Look no further than the rule of products. For every one that succeeds, another 10 or more will fail. Retailers must balance the cost of such initiatives with the potential return on investment.

To overcome these challenges, retailers need to adopt a flexible approach. Partnerships with local businesses and community groups can help offset costs and enhance the value of the space. For example, hosting events or workshops in collaboration with local artists or entrepreneurs can attract a diverse range of visitors and foster a sense of community.

The Road Ahead

“Experiential retail – a concept that involves creating unique, innovative, and interactive experiences for customers in a physical retail environment – will be a top trend.”

– NetChoice

As retailers continue to experiment with the Open HQ model, the key to success will be adaptability and a genuine commitment to customer engagement. By actively listening to shopper input and incorporating it into their design and development processes, retailers can create a dynamic and personalized shopping environment. This not only enhances the customer experience but also fosters a sense of loyalty and brand advocacy, as customers feel their voices are heard and valued.

The future of retail lies in creating spaces that are not just about selling products, but about building relationships and fostering creativity. Retailers have the opportunity to transform their stores into vibrant community hubs where ideas can flourish, and feedback is actively sought and appreciated. These spaces can host events, workshops, and collaborative projects that engage customers on a deeper level, making the overall experience more meaningful and interactive.

By prioritizing adaptability, embracing innovation, and valuing customer input, retailers can set new standards for what it means to create a truly engaging and dynamic shopping experience.