Sustainability is mission-critical for retailers. Consumers demand it. Shareholders want it. The earth needs it. So why is it so hard to walk the walk?

There’s a common misperception among retailers that investing in sustainable building will be too costly to achieve any kind of ROI. Yet efforts to reduce carbon footprint, while perhaps more costly upfront, can be beneficial for retailers in the long run. While it takes effort to source products that are sustainable, using eco-friendly designs and recycled materials in retail locations are just two examples of ways brands are getting closer to sustainability goals.

As we’ve explained before, improving sustainability requires a willingness to do business differently. We’ll explore sustainable building in retail and what the future holds for this approach.

The Importance of Sustainable Building Practices in Retail

According to Microsoft, sustainability is a growing priority in retail and consumer packaged goods. Industry leaders, employees, investors, partners, and consumers who buy the goods care about sustainability.

- 93% of CPG leaders spend more time on sustainability issues today than five years ago

- 73% of Millennials prioritize sustainability over pricing

- 55% of recent CPG market growth came from sustainability-marketed products

By implementing sustainable practices, retailers not only gain a competitive advantage with eco-conscious consumers but also reduce their carbon footprint.

Virtue Signaling vs. Environmental Commitment

Retailers who talk sustainability without verifiable actions raise doubts about their commitment. Virtue signaling – talking the talk without walking the walk – can instantly destroy a brand’s credibility. And even though there is a gap between what consumers say they expect and what they purchase, the intent for better sustainability is a growing trend among consumers and stakeholders. And with more legislation requiring specific commitments to sustainable practices, getting ahead of the curve can be cost-effective.

Sustainability Begins Before Building

As retailers refine their sustainability efforts, the first consideration is location. More than ever, sustainability includes answering the question, “How far do I expect my customers to travel to shop in my store?” The answer is often not as far as they used to. Smaller stores embedded in neighborhoods are a more sustainable alternative to larger stores that use more energy and require a longer trip to access.

What Steps Are Retailers Taking to Be More Sustainable?

There are a number of ways retailers can incorporate sustainability into buildings and materials—some might be easier and more cost-effective than you think.

Energy-Efficient Lighting

Energy-efficient lighting is one of the key components of sustainable building. It’s more than just LED lights, although that is an important component. LED lighting uses much less energy than traditional lighting and can last decades longer. However, other considerations can help with more sustainable lighting as well. Choosing to construct buildings in ways that take advantage of natural lighting can help save even more.

Efficient HVAC

Energy-efficient HVAC systems help significantly reduce energy consumption. While lower utility bills are the most obvious benefit of an efficient HVAC system, other benefits include better air quality and reduced health risks for employees and consumers.

Eco-Friendly Materials

IMM-Cologne explores the use of sustainable materials in retail design in great depth. They suggest solutions from the circular economy:

- Terazzo floor slabs, bricks, and recycled concrete produced from construction waste.

- Recycled PVC or vinyl floor coverings.

- Recycled clothing made into curtains, shelving, counters, and more.

- Alternative construction materials such as hemp, rapidly regrowing bamboo, or recycled plastic.

IMM-Cologne makes the argument for the importance of pursuing sustainability:

“Rising energy costs, shortages of raw materials, the new awareness in society and the increasingly visible consequences of climate change call for a new way of thinking. This should ultimately benefit everybody: companies, people and, above all, the environment.”

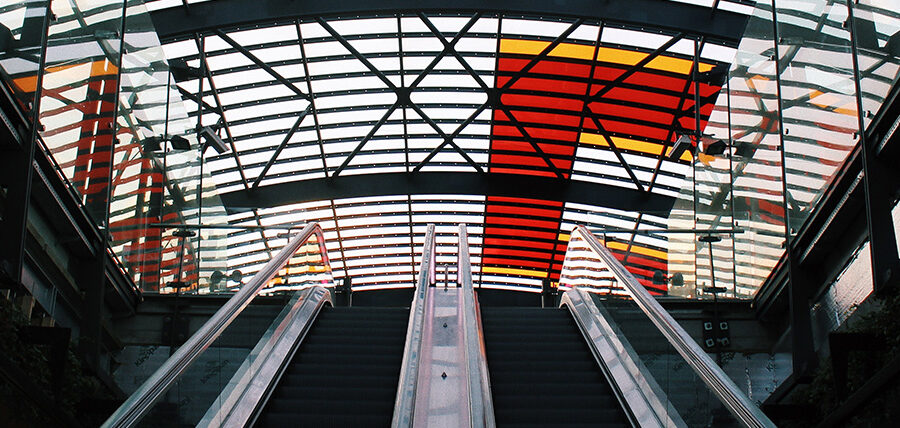

Eco-Friendly Retail Design

Sustainable building can also include using eco-friendly designs like green roofs and walls. Green buildings reduce heating costs by adding insulation while also reducing the urban heat island effect. According to the University Corporation for Scientific Research on urban heat islands,

“Heat islands form as vegetation that is replaced by asphalt and concrete for roads, buildings, and other structures necessary to accommodate growing populations. These surfaces absorb—rather than reflect—the sun’s heat, causing surface temperatures and overall ambient temperatures to rise.”

When retailers incorporate green roofs and walls into their structures, they help reduce this effect.

The Benefits of Sustainable Retail for Businesses and Consumers

Sustainable retail practices are good for the environment, but they also provide measurable advantages for businesses that implement these practices and the consumers who support them. Sustainable building can save retailers money on energy and water bills while also allowing them to connect with consumers on a deeper level, earning more customer loyalty. Plus, consumers benefit from a healthier shopping experience in buildings with improved ventilation and natural lighting.

“Some people will say sustainability is an additional cost, but once they’re doing it, it becomes second nature and integrated into how they do business,” said Sabine Schlorke, global manager for manufacturing at the International Finance Corporation, a member of the World Bank Group, in an interview with PWC. “If you see it as part of your business, it’s not a cost; it’s an opportunity.”

A Consumer Shift

“I hope when the industry slows down (in a good way), we will be able to focus more on using the sustainable products of the future—fixtures, building materials, flooring, and even playing around with 3D printing to make small tables and stuff,” he says. “It’s the future. I hope we can use it to think bigger.”

– Andrew Miller, ASG procurement and materials manager.

Consumers are becoming more environmentally conscious, choosing products with sustainable packaging and shopping brands whose values match their own with regard to sustainable efforts. Retailers have been rushing to get ahead of pandemic-related supply chain struggles, but making efforts to implement sustainable building practices where feasible demonstrates that they are listening to their customers. The effort and transparency go a long way in building a strong brand reputation and earning customer loyalty.