share this article

Meet Martine Body, the newest Partner of Design Development at ASG / Chute Gerdeman.

An Ohio native, Martine’s journey began at Fort Hayes with commercial photography studies, leading her to a BFA in Interior Design from the Columbus College of Art and Design. Her love for travel fueled experiences throughout Europe, Asia, Latin America and South Africa shaping her design perspective.

She started honing her skills at Limited Brands, GSW Worldwide, and a previous role at ASG before embarking on a successful 14-year career at Express, leading the Store Design and Construction team. There, she completed projects across the US, Middle East, and Latin America.

Martine’s role on the team alleviates pain points for any retailer looking to scale their business through design. We’re a more flexible extension of our client partner teams, and capable partners as capacity surges. In a world where brands may hire and layoff talent after short tenures for projects, Martine’s skillset paired with the team’s abilities give us an edge to be a safer, more efficient solution for various retailers.

“Martine bridges the gap between design and construction. Her capabilities improve our product and service outcomes, while creating a place to foster innovation/adaptability, improve overall efficiency and client satisfaction. We can move from design to construction faster, better, and iteratively.”

—Carrie Barclay, CEO

Now a partner at ASG, heading the design development team, Martine thrives in fostering collaboration. She is known for her ability to tackle complex problems, cultivate strong team values, and develop clear strategies. Building trust and fostering connections are key tenets of her leadership style, leading to successful compromises and seamless collaboration.

“I’m thrilled for my new adventure at ASG, where I can embrace new people and experiences. I’m going to challenge myself and the team to continuously push retail and develop the most satisfying customer experiences with client success and results in mind.”

—Martine Body, Partner, Design Development

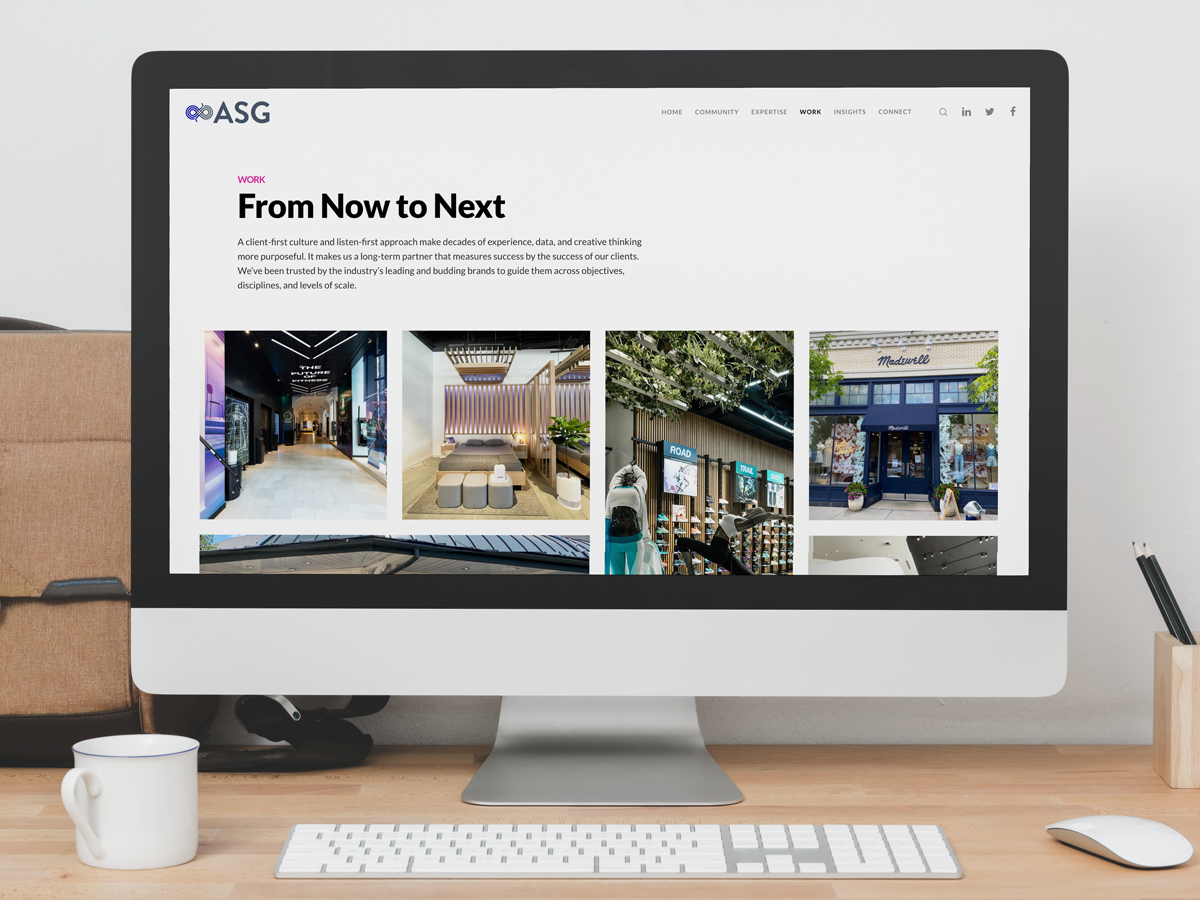

ASG is a retail strategy agency, fueled by strategic partners. We’re inspired by an industry we love and the brands we support. Informed by leading edge analytics, creative curiosity, and decades of experience, we provide integrated solutions for your interconnected needs. We drive change across retail strategy, design, build, portfolio management, and guide brands to what’s next.